Everything You Need to Know About Tax-Free Shopping in France with ZappTax

Feature

Anyone whose main residence is outside the European Union has the right to a VAT refund on purchases made in the EU and taken home, in their luggage, to their country of residence. While tax-free shopping is a great and profitable option for non-EU residents, the process is complicated and cumbersome. ZappTax has made it its mission to facilitate the VAT-refund process so that everyone who is eligible can take full advantage of their right to save.

ZappTax is happy to offer this straight-forward solution to make VAT refund simple to understand and obtain. Here’s how it works.

What is a VAT refund and do you qualify?

Definition by the French Directorate General of Customs and Indirect Rights (DGDDI):

“The traveler whose domicile or habitual residence is not in France, or another Member State of the European Union can buy goods for export exempted from paying the value added tax (VAT) or benefit from a refund of this VAT”

Thus, goods purchased in the EU but then taken with you in your lug- gage for consumption or use in your country of residence outside the EU are not subjected to VAT.

In order to claim a VAT refund on your purchases, you must meet cer- tain conditions.

1. You must reside outside the European Union

You can claim a VAT refund only if you live in a non-EU country. This is independent of nationality. A French expatriate in Bangkok will there- fore be eligible for a VAT refund, but an American residing in Italy will not. A person of Chinese nationality residing in Paris is also ineligible for a VAT refund when travelling outside the EU. Since the Brexit, UK residents are eligible for VAT-refund when they travel to Europe.

2. A minimum purchase threshold to claim VAT refund is set by each country

Depending on how the VAT refund on your purchases is obtained (see below), this threshold is applicable per store and per day (which is very restrictive) OR it is applicable on all the purchases made during your stay.

3. You must leave the EU before the end of the third month following the month of purchase

Most countries will only refund VAT if you leave the EU with your purchased goods and obtain customs validation of your tax-free form no later than the last day of the third month following the month of your purchase.

4. You have to leave the EU with all the goods on which you want to claim a VAT refund

In order to get your VAT refund, you must take purchased goods out of the EU with you in your luggage. If these goods remain in the EU, you cannot claim a VAT-refund on them. Note that these goods must be unused and in their original packaging when they leave the EU.

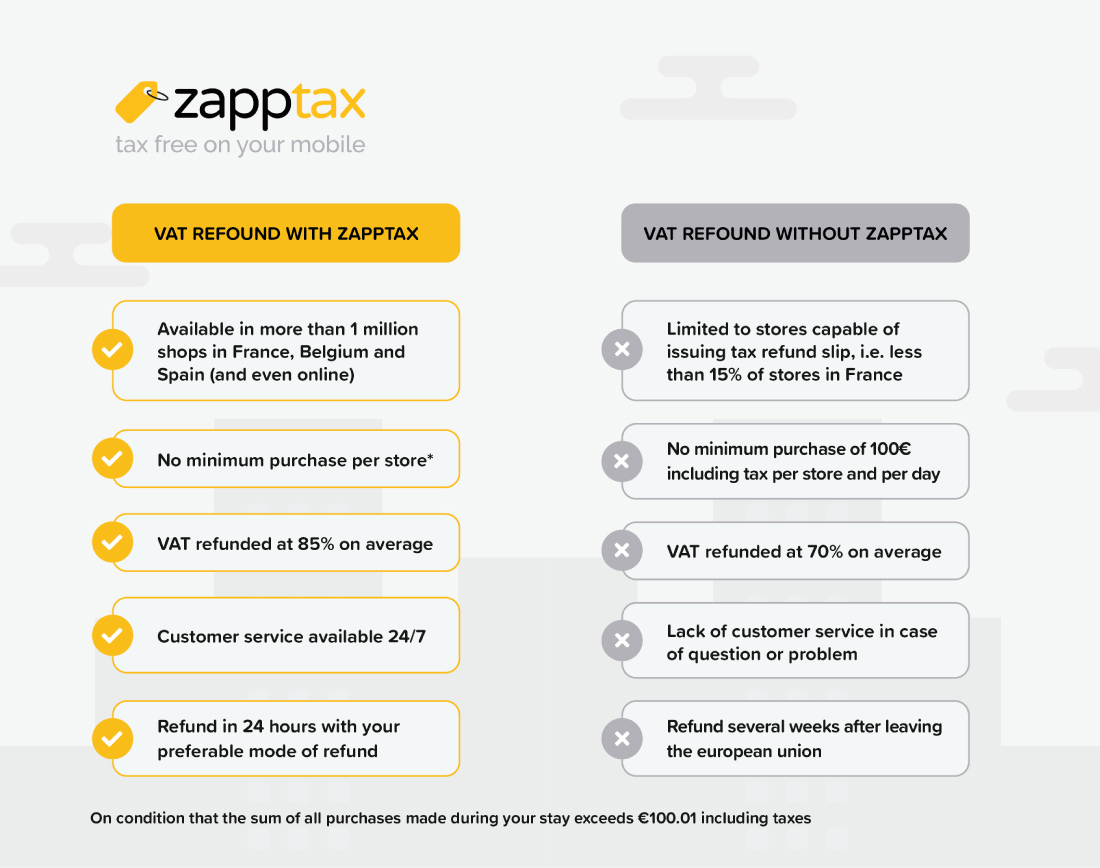

Why use ZappTax?

In 2017, ZappTax devised an innovative system that overcomes almost all the problems of the traditional VAT-refund system. This new ap- proach, approved by the tax and customs authorities, works differently. You have two ways to shop tax-free:

- The traditional system is to have VAT refund provided by the vendor, most often in collaboration with an intermediary called a “tax-refund operator”.

- The easy, government-approved ZappTax system, which simplifies the VAT-refund process and can be used when shopping in any store in France, Belgium, or Spain.

How to Use ZappTax

1. Simple, fast, and easy process

First, download the app here, sign up, and create your profile. When shopping, simply ask for an “invoice including VAT in the name of ZappTax”. All merchants are legally obliged to issue such an invoice on request. All you need to do is take a photo of each invoice and upload it to the ZappTax application.

2. Applies to all your purchases, with no maximum, even your online purchases

Once you’re done with all your purchases, ask the ZappTax team to generate your tax-free form. This will be sent to you by email and stored for retrieval at any time in your ZappTax app account. You will need to scan* this tax-free form (in France and Spain, directly from your smartphone at a self-service terminal; in Belgium, by showing your passport to the customs officer) when leaving the EU.

*If you leave the EU from a different country than the country of purchase (ex: you purchased in Belgium but leave from Paris), you must print your form to get it stamped.

3. Larger and faster refund

When you use ZappTax for all your purchases, the savings really add up: we reimburse up to 85% of your VAT. Once your documents have been validated, your VAT refund will be available within 24 hours, depending on your chosen payment method (Bank account, PayPal, Alipay…).

4. 24/7 customer service

We’re here to help you every step of the way, and our team is available via in-app chat, email ([email protected]), phone, or social media.

If you still have questions about VAT refunds or the ZappTax app, check out our FAQ

Happy Tax-Free shopping !

Download the App!

In 2017, the co-founders of ZappTax (both residents outside the EU and therefore eligible for VAT refund) devised an innovative system that overcomes almost all the problems of the traditional VAT refund system.

ZappTax’s mission is plain and simple:

Help international travellers to more easily obtain refunds of the value added tax (VAT) they pay on goods they purchase while travelling abroad. ‘More easily’ means a more convenient and streamlined refund process, higher and faster refunds… combined with 24/7 flexible and instant customer support during the entire refund process.

DOWNLOAD THE ZAPPTAX APP FROM THE APP STORE OR GOOGLE PLAY

In the event of problems or if you just have questions, our team is available 24/7 via in-app chat, email ([email protected]), phone, or social media.

Share to: Facebook Twitter LinkedIn Email

More in advice, App, Help, Manage, tax

By ZappTax

Leave a reply

Your email address will not be published. Required fields are marked *