News Digest: French Tax Declarations Open, More Strikes & A Second-Home Owners Visa?

News

It’s back to work after a long Easter weekend in France, plus French tax declarations open, we announce our upcoming Visas & Health Insurance webinar, and there’s another nationwide strike planned. Here are the French news stories you need to know about this week.

1. French tax season opens

It’s that time of year again – French tax season. If you’re resident in France, you must, by law, file a 2023 income tax declaration for your household and declare all of your French and worldwide income earned in 2022. Importantly, this applies to all individuals and/or households, including those who have no tax to pay or have already paid their contributions via the PAYE system.

Non-residents and French property owners don’t typically need to fill in a French tax return (even if you pay property taxes), unless you have French income from rentals, investments, or other sources.

2023 tax declarations open this Thursday, April 13th, from when you will be able to fill in your tax declaration online at impots.gouv.fr. The exception is for those filing their very first tax declaration in France – in this case, you must submit a paper form. The deadlines for filing your return are between 6-8 weeks, depending on whether you are submitting a paper or online form and the region of France in which you live.

We’ll be helping you through tax season as best we can with a series of articles and FAQs being published over the next few weeks (keep an eye on FrenchEntrée.com), but the best place to start is my Editor’s Pick: 12 Essential Articles to Get You Through French Tax Season

You can also check out the replay of our French Tax webinar with tax experts Elitax over on our FrenchEntrée YouTube channel (don’t forget to hit the subscribe button so you don’t miss out on all our free upcoming content).

2. Is there hope for a second-home owner’s visa in France?

A campaign has been launched by France Visa Free in cooperation with French senator Jean-Claude Requier to bring in new visa regulations for second-home owners in France. The senator will be proposing the changes as an amendment to an immigration bill currently (from March 28) being debated by parliament.

The aim is to alleviate the constraints of the 90/180-day rule for British owners of French property who, as a result of Brexit, now face limitations on their annual trips to France. The group isn’t asking for more time to be granted, but rather for it to be possible to enjoy this time consecutively – Brits can currently stay a total of up to six months in France or any other Schengen area country, but only for 90 days at a time. Among the proposals are a renewable online temporary long-stay visa which would dramatically simplify the current application process or a ‘property owners visa’ that would allow six-month stays in France over a five-year period.

If you want to find out more about the campaign or join their efforts, check out the link above.

3. Will this be the last of France’s pension reform strikes?

As Macron’s government awaits the ruling of the Constitutional Court, which will decide on whether the proposed pension reform bill is constitutional, unions are preparing for a 12th day of nationwide strikes in protest. The next strike will take place this Thursday, April 13th – the day before Constitutional Court is set to announce its decision (Friday, April 14th).

Transport will hopefully be less impacted than the earlier strikes, but you should still expect cancellations and disruptions on some SNCF trains and public transport (as a rough projection, around 3 out of 4 trains ran on the last strike day, and all but three Paris metro lines ran as normal). Air travel and tourist attractions may also be affected, and garbage collectors in the Paris region will also be starting another rolling strike on the same day. It’s likely that marches and demonstrations will take place in towns and cities around France, and there may be blockades or extra traffic around large cities as a result.

If you’re wondering when the strikes might end, this Friday’s ruling will likely be the turning point. The constitutional ruling marks the last legal possibility for preventing the government from moving ahead with the reforms, so the result will be seen as definitive. Whether or not the unions will give up at that point remains to be seen – many union leaders have indicated that while they will accept the decision of the court, they will continue to display their disapproval.

4. Sign up for our Visas & Health Insurance webinar

We’re excited to announce our next FrenchEntrée free webinar, which will be taking place at the end of the month. Kicking off our new Moving to France webinar series, we’ll be focusing on long-stay visa applications and health insurance – the first steps to becoming resident in France.

I’ll be joined by expert advisors from French Connections HCB and FAB French Insurance, who will be answering some of your most frequently asked questions on long-stay visas, the visa application process, and the health insurance requirements, with plenty of top tips and essential advice. If you’re a non-EU citizen looking to move to France to work or study, plan to retire to France, or perhaps just want to enjoy a long stay at your French second home – this is your chance to put your questions to the experts! As always, you can send your questions in advance to me at [email protected].

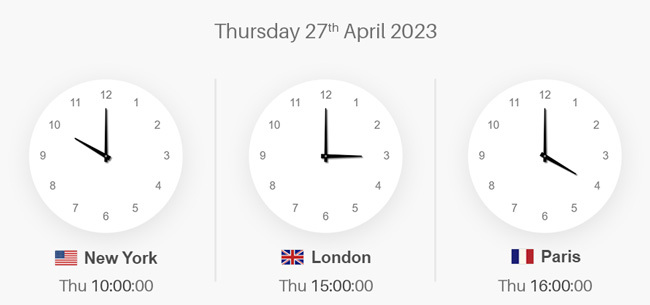

Sign up for our free Moving to France: Long-Stay Visa Applications & Health Insurance webinar on Thursday, 27th April at 3pm BST or click the button below.

Share to: Facebook Twitter LinkedIn Email

By Zoë Smith

Leave a reply

Your email address will not be published. Required fields are marked *

REPLY

REPLY