Using the chèque emploi service universel (CESU)

May 2014

By Sylvia Edwards DavisThe Chèque emploi service universel (CESU) scheme is designed to simplify the formalities for private individuals to hire domestic help or other jobs related to the home, in compliance with French labour law. Subject to the agreement between employer and employee, the Chèque emploi service universel or CESU can be used to pay for the following types of services: In the home:

- Cleaning

- Ironing

- Preparation of meals

- Care of a sick or infirm person (not including medical care)

- Small gardening jobs or jobs around the house

- Computer and Internet assistance

- Help with administrative formalities

- Private lessons

- Part-time house watching, maintenance or repairs

- Outside the home for tasks related to services provided in the home:

- Shopping

- Preparation and delivery of meals, cleaning and delivery of laundry

- Transporting persons who have difficulty with mobility

- Accompanying elderly and infirm persons or children outside of the home (on walks or public transport, in everyday activities)

- For dependent elderly persons or persons with disabilities:

- Dog walking and pet care (not including veterinary care or grooming)

- In-home hairdressing and manicure services

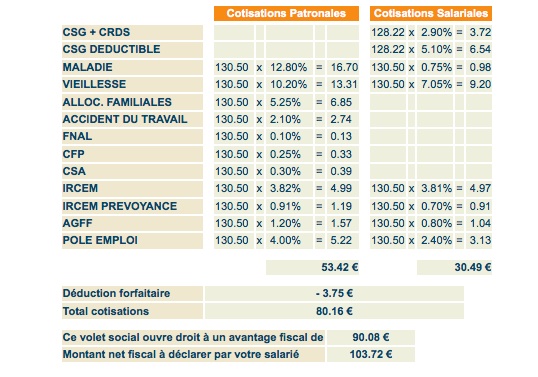

- The Cheque d’Emploi Service (CES) will deduct by direct debit from the employer’s bank account the relevant social charges in proportion to the amount paid to the employee. Example:

In this simulation a homeowner hires a gardener to work for 5 hours at a rate of €20 per hour. The gardener cashes the cheque and gets paid €20 per hour x 5 hours = total €100. The CESU system is notified of the payment and they then take the cotisation patronales of €53.42 from the bank account of the homeowner by direct debit. The gardener will be responsible for the €30.49 cotisations salariales and will receive a pay slip with a detail of the social charges paid. The homeowner gets notified by post of the breakdown of the social charges which can be included in the yearly income tax return and result in a tax crédit or réduction – depending on the fiscal scheme of the employer – up to an amount of € 90.08. In practice In order to use the system you first need to register as an employer online at www.cesu.urssaf.fr. The CESU chequebook To obtain a personalised CESU chequebook fill in the CESU application form that you will receive in the mail and give it to your bank. In theory this should be enough for your bank to provide you with the chequebook, although it could take a few weeks for them to process the request. When you issue a payment, you also need to fill out the declaration form or volet social in your CESU checkbook, and send it to the Centre national du CESU using the pre-addressed envelope provided. In order to fill in the form for the service provider you will need their details: name, address, date and place of birth and social security number. Online Note that it is not mandatory to have a personalised chequebook in order to use the CESU system. Once you have registered as an employer, you can also pay with your own cheque (or cash) and fill in the form online at www.cesu.urssaf.fr or net-particulier.fr Source: Urssaf / Net-particulier.fr

In this simulation a homeowner hires a gardener to work for 5 hours at a rate of €20 per hour. The gardener cashes the cheque and gets paid €20 per hour x 5 hours = total €100. The CESU system is notified of the payment and they then take the cotisation patronales of €53.42 from the bank account of the homeowner by direct debit. The gardener will be responsible for the €30.49 cotisations salariales and will receive a pay slip with a detail of the social charges paid. The homeowner gets notified by post of the breakdown of the social charges which can be included in the yearly income tax return and result in a tax crédit or réduction – depending on the fiscal scheme of the employer – up to an amount of € 90.08. In practice In order to use the system you first need to register as an employer online at www.cesu.urssaf.fr. The CESU chequebook To obtain a personalised CESU chequebook fill in the CESU application form that you will receive in the mail and give it to your bank. In theory this should be enough for your bank to provide you with the chequebook, although it could take a few weeks for them to process the request. When you issue a payment, you also need to fill out the declaration form or volet social in your CESU checkbook, and send it to the Centre national du CESU using the pre-addressed envelope provided. In order to fill in the form for the service provider you will need their details: name, address, date and place of birth and social security number. Online Note that it is not mandatory to have a personalised chequebook in order to use the CESU system. Once you have registered as an employer, you can also pay with your own cheque (or cash) and fill in the form online at www.cesu.urssaf.fr or net-particulier.fr Source: Urssaf / Net-particulier.fr

Share to: Facebook Twitter LinkedIn Email

More in children, legal, tax, walking, work

Leave a reply

Your email address will not be published. Required fields are marked *