Understanding French Capital Gains Tax: What You Need to Know

Essential Reading

In France, real estate properties and moveable goods are subject to both capital gains tax and social charges. Capital Gains Tax applies to both residents and non-residents, and it can total more than 40% in certain circumstances, so it’s essential to understand your tax liabilities before you decide to sell your second home. Here’s what you need to know about French capital gains tax.

Are Capital Gains Taxed in France?

Yes. Capital gains, or plus-value in French, is payable in France on any profits made upon the sale or transfer of real estate property and moveable goods. The capital gains is subject to both income tax and social charges.

Capital gains tax applies to:

- Buildings (built and unbuilt), land, and other real estate assets

- Moveable property

- Shares of real estate companies

For the purpose of this article, we are focusing on how capital gains is taxed on the sale of a second home or property in France. To understand how capital gains tax is applied on other real estate investments and moveable property when gifting, transferring, or exchanging property or real estate assets or when selling business or shared property, we recommend getting in touch with one of our recommended international tax advisors.

Will I Pay Capital Gains Tax When I Sell My French Property?

Capital gains tax (impôt sur les plus values) and social charges (contributions sociales) are payable on the sale of property in France if it has sold for profit. However, there are some exemptions, most notably:

- No capital gains tax or social charges are payable on the sale of your main residence (including land and outbuildings)

- No capital gains tax is payable on a second home if you have owned the property for more than 22 years; no social charges are payable on a second home if you have owned the property for more than 30 years.

- No capital gains tax is payable on property sales under €15,000

Note: there are other exemptions and applicable conditions that are outside the scope of this article.

How Much is Capital Gains Tax in France?

Capital gains in France are subject to both CGT tax at a flat rate of 19% and social charges at a flat rate of 17.2% —a total of 36.2%. However, there are also allowances to take into account, supplementary taxes payable on large capital gains, and a reduced rate of social charges for EU and UK residents. In some circumstances, the total rate of CGT tax and social charges may be 42.2%; in other cases, it may be 0%.

Let’s take a look at the basic rates and allowances for CGT and social charges.

Income tax on Capital Gains in France

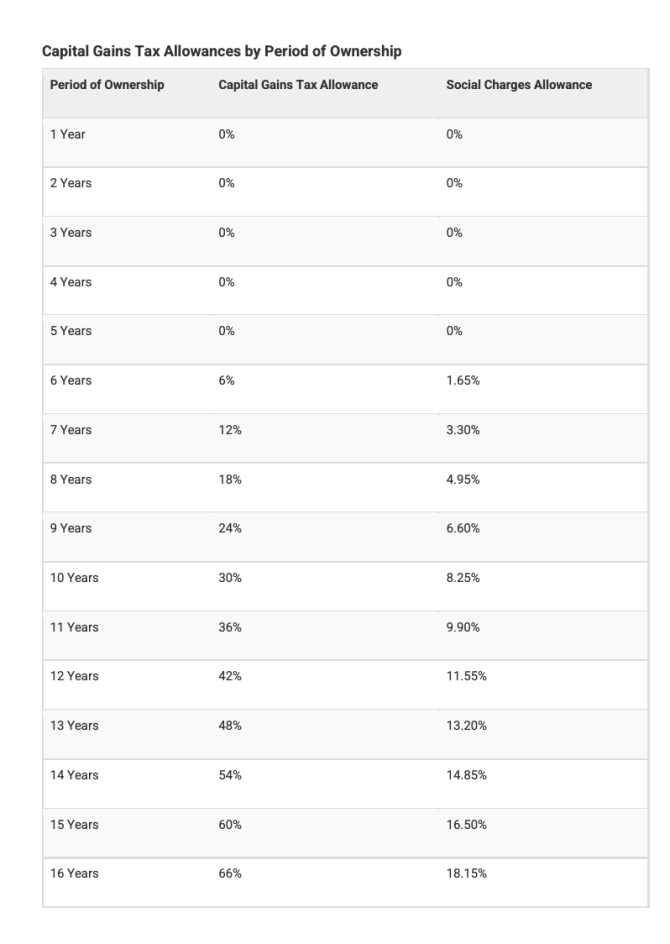

Income tax is charged at a flat rate of 19% on capital gains. However, there are allowances made depending on the length of time you have owned the property, known as the ‘L’abattement pour durée de détention pour l’impôt sur le revenu’ in France. After 22 years, your property sale will no longer be subject to capital gains tax.

If you have owned your second home:

- Up to five years: there is no allowance, and you will be subject to the full 19% capital gains tax rate

- Between six and 21 years: there is a progressive allowance increased by 6% each year up to a maximum of 96%

- 22 years or more: 100% (i.e. you won’t pay any capital gains tax)

Social Charges on Capital Gains in France

French social charges on investments and capital gains are calculated based on three different rates with a maximum total of 17.2%:

- CSG (Contribution sociale généralisée or Generalized social contribution) –9.2%/0%

- CRDS (Contribution pour le remboursement de la dette sociale or Contribution to the repayment of social debt) – 0.5%/0%

- Prélèvement de Solidarité (Solidarity tax) – 7.5%

The full rates apply to property owners who are resident in France or non-EU residents. However, EU/EEA residents and UK residents after Brexit are only subject to the 7.5% social charges (conditions apply; see the section on non-residents below).

Social charges are also subject to reductions depending on the length of time you have owned the property, with a complete exoneration after 30 years.

If you have owned your second home:

- Up to five years: there is no allowance, and you will be subject to the full rate of social charges

- Between six and 21 years: there is a progressive allowance increased by 1.65% each year up to a maximum of 26,40%.

- For the 22nd year of ownership: there is a + 1.60% increase

- Between 22 years and 19 years: there is a progressive allowance increased by 9% each year up to a maximum of 91%

- 30 years or more: 100% (i.e. you won’t pay any social charges on your capital gains)

Supplementary taxes

Supplementary taxes are also charged on top of the basic rate of CGT and social charges in the event of larger profits – capital gains of more than €50,000.

- For capital gains between €50,000 and €100,000, you will pay an extra 2%

- For capital gains between €100,00 and €150,000, you will pay an extra 3%

- For capital gains between €150,000 and €200,000, you will pay an extra 4%

- For capital gains between €200,000 and €250,000, you will pay an extra 5%

- For capital gains of more than €250,000, you will pay an extra 6%

How is capital gains tax calculated in France?

French capital gains tax rates and social charges are calculated based on:

- Your country of residence for tax purposes (more about this later on)

- The amount of capital gain (i.e. the amount of profit)

- Any exemptions or allowances you are entitled to (such as the allowances for the duration of ownership as detailed above)

- Any supplementary taxes that you may be subject to (as detailed above)

How are capital gains calculated on a French property sale?

The above capital gains tax and social charges are applied to the ‘gross capital’ on your sale; in other words, the amount of profit you made. This figure is decided by taking the difference between the acquisition price (the price you paid for the property including additional charges, notaire’s fees, or VAT) and the transfer price (the price at which you sold the property), minus any sales costs and VAT.

There are also possible deductions of 7.5% for acquisition costs, improvements and qualifying loan interest, but all of these are subject to conditions, and proof must be provided. Due to the above-mentioned allowances, the net capital gains amount subject to income tax may be different from the net capital gains amount subject to social charges.

As you are probably starting to realise by now, the calculation of capital gains tax in France is extremely complicated, and there are also additional deductions and conditions that you may need to consider that are not covered in this article.

Estimate your capital gains tax liabilities in France

The above figures are a good place to start when estimating your CGT liabilities, but with so many different factors at play they may not provide the full picture. When selling your property, your notaire will be responsible for calculating any capital gains taxes owed and will be able to advise you on any allowances or exemptions. Prior to meeting with a notaire, you could also run a simulation at Notaires.fr – their French capital gains calculator here is a useful tool.

For more specific advice on your situation, especially if you are dealing with multiple properties or have international property assets, it’s highly recommended to seek professional advice. See our list of international tax advisors for our recommendations.

Do I Need to Pay Capital Gains Tax in France as a Non-Resident?

Yes. If you own a second home or holiday home in France, you will be liable for capital gains tax in France when you sell your property, even if you are tax resident in another country.

Non-residents are charged the same 19% flat-rate tax as residents.

Non-residents are also subject to the same 17.2% social charges as residents. However, there is an important exception for residents of EU and EEA countries, as well as the UK post-Brexit. Residents of these countries who are affiliated with an EU/EEA/UK social security regime will be exempt from the CSG/CRDS taxes. They will, however, still pay the 7.5% solidarity tax.

Capital Gains for UK citizens and residents post-Brexit

Despite some confusion over this rule for UK sellers post-Brexit, it has now been confirmed that UK residents who meet the conditions will still qualify for the CSG/CRDS exemption. Read our guide to Social Charges on Investments and Capital Gains Post-Brexit: 17.2% or 7.5%? for more on this.

The CSG/CRDS exemption also applies to UK, EU, or EEA retirees who are resident in France but are not affiliated to the French social security system – i.e. residents in receipt of an S1 certificate.

Will I pay capital gains in both France and my home country?

Whether or not you will also be subject to capital gains tax in your home country will depend upon whether there is a double tax treaty between your country and France. Most countries, including the EU, the UK, and the United States, have double-tax treaties in place, allowing full or partial relief from capital gains tax in your own country.

However, it’s essential to understand your liabilities in both countries before proceeding with a sale and be sure that you check whether both the French tax and social charges can be offset against tax liabilities in your home country.

For example, UK residents are liable for capital gains taxes in the UK; however, CGT payments and the 7.5% prélèvement de solidarité made in France can be offset against your UK tax liabilities (however, any other social charges incurred may not be offset in the UK). If the tax liability in the UK is greater than that of France, you will be required to pay the difference. If the tax liability is lower in the UK than that of France, you will still be required to pay the full amount in France.

The general rule of thumb is that while you won’t pay CGT taxes twice, you will normally end up paying the higher of the two rates. Read the official statement on French CGT and social charges for non-residents here.

Do I Need to Pay Capital Gains Tax in France on my UK or US Property?

Do I Need to Pay Capital Gains Tax in France on my UK or US Property?

If you are resident in France and sell a second home in the US, UK, or another country, it’s important to note that you will also be subject to French capital gains. However, similar to selling your French property as a non-resident, you will typically receive a tax credit in France from your property sold overseas.

This depends upon the double-tax treaty between the two countries, and it’s essential to ensure you understand your liabilities in both countries.

Paying Capital Gains Tax in France

All property sales in France must go through a notaire, and it will be the notaire’s responsibility to calculate the capital gains tax due. They will withhold the amount due at the time of the sale and ensure that all taxes and social charges are paid on your behalf.

If you are not resident in France and live outside of the EU, Iceland, or Norway, you must also employ a fiscal representative accredited by the French Tax Authority, who will be responsible for your capital gains tax declaration.

Paying Your Taxes in France

Whether you are moving to France, own French property, or have business interests, assets, or investments in France—FrenchEntrée is here to help with all your tax questions. Our Essential Reading articles will talk you through all the basics, from income tax and social charges to wealth tax and property taxes. However, international tax liabilities can be complicated, so if in doubt, we always advise discussing your personal situation with one of our recommended financial or tax advisors.

Disclaimer: This guide is provided for general information purposes only and is not intended to be a substitute for professional advice regarding any aspect of your tax planning or tax liabilities in France. FrenchEntrée cannot be held responsible for the consequences of decisions or actions you may choose to take in connection with French tax declarations or tax liabilities.

Share to: Facebook Twitter LinkedIn Email

By FrenchEntrée

Leave a reply

Your email address will not be published. Required fields are marked *

REPLY

REPLY