What a Difference a Day Makes: a Day in the Life of the GBP/EUR Exchange Rate

With international conflicts, interest rates and energy crises taking their toll on economies in the UK and Europe, exchange rates have fluctuated tremendously. If you are involved in a property transaction it is more important than ever to get some guidance well in advance of your payments as -even on a single day- the fluctuations in the rates can be quite substantial.

It is key to plan things in advance but a good practice would be to get some assistance at the point of signing the purchase contract. At this stage, it is a good idea to check where the markets are and plan not only the best way to pay the deposit but also how to organise the final payment of funds. Leaving the exchange to the day of completion could leave you exposed and potentially out of budget.

Having a currency specialist at hand during your property purchase in France will help you to reduce your risk exposure, plan your transactions and guide you through the process from start to finish.

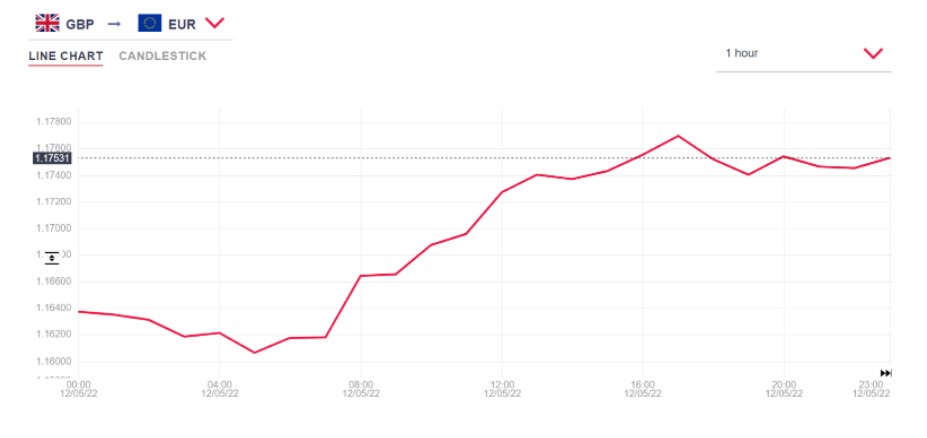

A date as an example: 12th May 2022

Below we have taken a snippet from the 12th May 2022 where we saw the GBP/EUR exchange rate move from a low of 1.1606 to a high of 1.177.

For a buyer who had to pay their completion on a property of €300K on the 12th May would have been exposed to a volatile market, receiving a different rate depending on the time in the day they had traded. This would have had an important impact on the cost of the transfer and ultimately on the final price of the property.

At 7am on 12th May 2022 €300K at 1.160 = £258,486

At 5pm on 12th May 2022 €300K at 1.177 = £254,884

This 10 hour period produced a difference of £3,600, which for a budget sensitive buyer could be the difference between being able to afford the property.

How a currency specialist can protect you from negative movements:

A currency specialist could prevent you from this exposure by giving you the ability to plan your transaction and take advantage of some currency tools that can help you optimise the transfer and control the total cost involved.

It generally takes around three months between the purchase contract or “Compromis de Vente” and the day of the signature of the title deeds by the notaire. This gap creates a risk to your transaction but also an opportunity to secure or even maximise your budget.

Below is a graph that shows the exchange rate movements between the “Compromis de Vente” and the completion date which in our case was scheduled for the 12th May.

A currency specialist will provide the buyer with many options to protect their budget. For instance, in our example, the buyer could have decided to fix the exchange rate on the full purchase price at the time of paying the deposit via a forward contract on the 12th February. This would have meant €300k would have cost you £251,046, a potential saving of £7,440 compared to the rate on the 12th May.

Or the buyer could have decided to target a higher rate of exchange via a market order and get a rate of 1.20 which was achieved on the 1st March as shown in the graph.

As you can see there is no one size fits all. A currency specialist will assess your circumstances, timeframe and budget to support you with your transactions to best protect your budget. Evidently, planning is essential and the earlier you get in touch, the more time a currency specialist has to support you efficiently.

Why moneycorp?

With a Platinum Trusted Service Award 2020 from independent review site Feefo and 40 years of experience in the industry, FrenchEntree has been recommending moneycorp for more than 15 years. During this time they have helped thousands of client planning the best way to pay for their property as well as supporting them afterwards with any further payment from paying bills, mortgages to repatriating UK pension payments for those who have retired to France.

Furthermore, we have worked with the same person at moneycorp for more than a decade! You might be familiar with her as she often writes for our FrenchEntree magazine. She has 13 years’ experience in foreign exchange, and is a qualified European lawyer with experience in European transactions. Mar will be happy to answer any questions or enquiries to support you through these difficult times

Opening an account is really easy and free of cost. You can register online or over the phone in a couple of minutes and for FrenchEntree there are no transfer fees in any payment.

Contact Moneycorp at +44 (0)79 12248625

Send your enquires to Mar at [email protected]

Share to: Facebook Twitter LinkedIn Email

More in currency exchange

Leave a reply

Your email address will not be published. Required fields are marked *